We help you form a California corporation or LLC without the complexity & hassle.The new tax law has opened new opportunities for individuals & businesses seeking to take advantage of the new changes. Maybe you’ve heard of the advantages of forming an LLC or an S-corp. We specialize in navigating our clients through the intricate landscape of forming a pass-through business entity. Forming a California corporation or LLC presents its own set of intricacies and we have over 15 years of experience + knowledge helping our clients find the best path in creating their business entities. How we serve you:

|

Contact Us

|

TESTIMONIALS FROM SATISFIED CLIENTS

“Owning a small business or simply being self employed certainly has perks! Not having a large HR department or a Legal Department isn’t one of those perks. Luckily, you can have David on your team. If you are a small business, self employed— or creating a new venture, gather all your bits and pieces and meet with David. He will help iron out the details, fill in the blanks, and put you on the right track. “

– Audra W.

“I required David’s services to change the status of my small business from a sole proprietor to an LLC, and he was fantastic to work with. He had everything set up and ready to go extremely quickly and efficiently. He explained the process clearly and was very responsive to my email questions. I would not hesitate to recommend David for anyone needing legal services – he’ll get the job done in a pleasant and efficient manner.”

– Erin P.

“We started a new business not too long ago and we needed a lawyer to help set up our LLC. David and his firm were very helpful and VERY efficient. He had everything ready for us within a day or two and we were up and running in no time. He had the expertise to help us choose the best setup for our company and gave us great advice regarding the ownership and participation structure for of each partner.

He is always available to help and give you advice and we really enjoy working with his firm.”

– David A.

TYPES OF BUSINESS ENTITIES

Here are some of the key concepts to understand the different types of business entities:

CORPORATIONS, LLCS, AND PARTNERSHIPS

CORPORATIONS, LLCS, AND PARTNERSHIPS

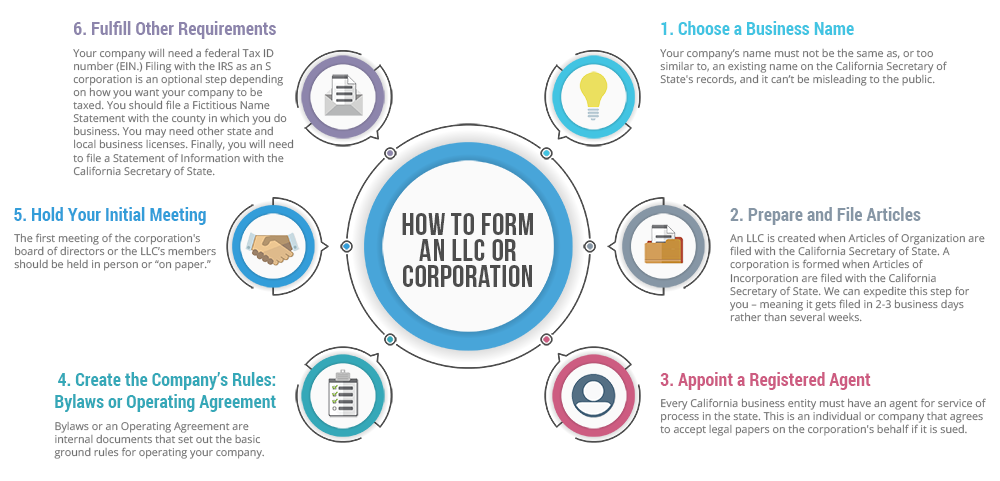

These are among the variety of forms that your business may take. Sometimes this is referred to as the “type of entity.” These include:

Solo Businesses (also known as Sole Practitioners)

This is the default status if you’re working on your own and you haven’t filed the paperwork to form any other type of legal business entity.

Corporations

Tip: Often, startup businesses will create S corporations, which is simply a tax election that may be favorable for early stage entities.

LLCs

An LLC is a limited liability company. LLCs operate in a manner that’s similar to a corporation, but usually require a bit less formality, which can translate into cost savings.

Partnerships

Sole practitioners and partnerships are less costly to form than corporations or LLCs, but they don’t provide the same level of liability protection. As a sole practitioner or partner, your personal assets may be subject to attack in the case of a lawsuit.

Memberships

|  |  |  |  |  |  |

Company History & Bio

David Lizerbram is an attorney in private practice. He is also the host of Products of the Mind, a podcast about the intersection of business + creativity.

David Lizerbram is an attorney in private practice. He is also the host of Products of the Mind, a podcast about the intersection of business + creativity.

David Lizerbram & Associates was founded in 2005 in San Diego, California with the goal of providing high-quality legal services to entrepreneurs both locally and nationwide. Since the firm’s creation, David has assisted with a large variety of business matters. His clients have varied in size from solo entrepreneurs to publicly traded companies. David has provided legal guidance on multimillion-dollar rounds of fundraising, negotiated strategic partnerships with nationwide businesses and nonprofits, managed international intellectual property portfolios, and advised many innovative startups.

David was born in Philadelphia and raised in North County San Diego, California. After graduating from the University of Southern California School of Cinema-Television (now the School of Cinematic Arts) and USC’s Marshall School of Business, he received his J.D. from Loyola Law School in Los Angeles. David speaks regularly about legal matters, and has presented on a legal education panel at San Diego Comic-Con every year since 2008. In 2011, David was appointed by California Governor Jerry Brown to the Board of Directors of the 22nd District Agricultural Association, which is responsible for oversight of the Del Mar Fairgrounds. He served in that position until the conclusion of his term in 2015. He also served on the Board of Directors of the San Diego Music Foundation and was a co-founder of the Craft Beer Association of San Diego, a think tank focused on promoting San Diego County’s dynamic craft beer industry. David lives in North Park, San Diego with his wife, Mana Monzavi and their son, Miles.